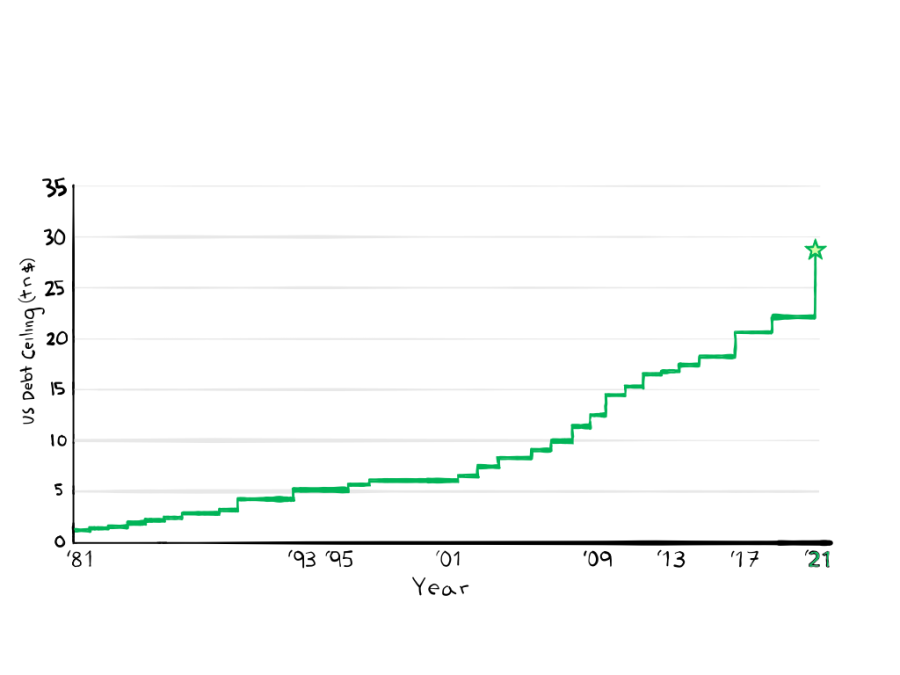

In order to prevent a historical default on the national debt, President Joe Biden signed a bill that will raise the national debt limit by $480 billion until early December.

Economics teacher Grant Blackburn said the purpose of the debt ceiling is to limit national spending.

“The idea is that there should be a limit on the amount of money that the United States government borrows,” Blackburn said. “If you hit that limit, you need another authorization before you can borrow more.”

However, in recent years, Congress has raised the debt ceiling frequently. The most recent, though temporary, was on Oct. 14.

“It was kind of a partisan issue where neither Democrats or Republicans wanted to agree or take responsibility for being the ones to raise the debt ceiling,” Berkeley business major Pallav Chaturvedi said.

So why have a debt ceiling if raising it becomes a political issue? A big reason to is to keep government spending in check, Chaturvedi said.

“You wouldn’t want to have unlimited spending, because you need to have checks and measures in place to ensure that the government is spending responsibly,” Chaturvedi said.

However, Blackburn said there are pros and cons to a debt limit if the limit is constantly being raised.

“On the one hand, the debt ceiling can be seen as a good way to prevent run-amok spending,” Blackburn said. “But it can also be seen as just being really annoying.”

Blackburn also said government spending is important for the economy, and debt is how the government finances its operations and expenses, whether that be for funding new infrastructure projects, funding foreign aid, general operations or to keep the U.S. economy healthy.

“You can use that budget as a way to influence the economy, because the government — on its own — accounts for 20% to 25% of all spending in the economy,” Blackburn said. “The prescription is during a recession, you want to raise government spending and lower taxes.”

For example, during the pandemic, the government gave stimulus checks as a way to boost spending when a lot of people were saving money.

“So for the pandemic instance, some people just got cash,” Blackburn said. “Other funding went to businesses, and (the government) said, ‘If you have a certain number of employees, we’re going to give you a loan to help continue to pay for your employees.’”

Blackburn also said the purpose of government spending on the economy is to create more consumer spending, which should create growth in the economy.

“The idea is that there’s all kinds of ways that you can spend your money or reduce your taxes so that more people have more money, and when more people have more money, they go out and spend it, which causes growth,” Blackburn said.

One way that the government accumulates debt to finance spending is through bonds.

“Bonds are the way that our country goes into debt,” Blackburn said. “So when a government wants to borrow money, they sell bonds to the economy, whoever’s willing to purchase it.”

According to Blackburn, the reason people may buy government bonds is that there’s interest paid back, meaning the person who bought the bonds gets paid a small amount until their bond expires, and they get the money they put in, along with the interest. Interest on bond payments is in case the government doesn’t pay it back. However, this has never happened.

“And because the United States government has never defaulted on a debt, it makes it extremely safe,” Blackburn said.

A clean historical record of always paying back debt makes bonds a safe investment, Chaturvedi said.

“Sometimes it’s considered to be what’s called a risk-free asset,” Chaturvedi said. “So if you have a risk-free asset that actually has a risk of default, it would have a pretty big impact on the global bond market.”

Chaturvedi said if U.S. bonds were to suddenly become risky, interest rates would need to rise accordingly, to compensate for the higher risk.

In fact, there are classifications for how risky bonds are. For example, the S&P has its own credit rating system, ranging from AAA to D, which would indicate that the entity has already defaulted on its debt payments.

The U.S. has had a historically high credit rating, with a AAA rating from the Dominion Bond Rating Service and from Fitch Ratings. However, in 2011, the S&P downgraded the U.S.’s credit rating from AAA to AA+. This rating still stands today.

“And so what it really came down to is that they had lost confidence for a few weeks,” Blackburn said. “It’s like, ‘I know, you haven’t screwed up yet, but we’re worried you might.’”

The fear of not being able to pay back debt could come back as Congress fights against defaulting on the expiration of the temporary raise of the debt ceiling. When this happens there could be a downgrade in the U.S. credit rating due to the higher risk of default. However, both Blackburn and Chaturvedi said bond ratings don’t have as large of an effect as people may think.

“A lot of people in financial markets take credit ratings with a grain of salt,” Chaturvedi said. “They don’t actually have as much meaning as people like to believe.”

And despite some people’s concern with government debt, Blackburn said it is important for the U.S. economy.

“All of the money in the United States is created through debt,” Blackburn said. “Our currency is a fiat currency, meaning that it is not based in value on anything other than supply and demand.”

So if suddenly some of the money’s value turned to dust, the value of all of the other dollar bills in circulation would have no limit as to how low it could go, he said.

“Because we could default on it, let’s keep in mind that if we were to get rid of all of the debt, at least under the current system, all the money would go away,” Blackburn said. “They would need to create a new monetary system.”

And while raising debt avoids the problem of voiding the value of the dollar, raising the debt ceiling only pushes the problem for the future.

“If you think about it, logically, I think it’s kind of odd because that just means they’re delaying the problem maybe by a few months,” Chaturvedi said. “So I think in a couple months, you’ll see the same thing play out.”