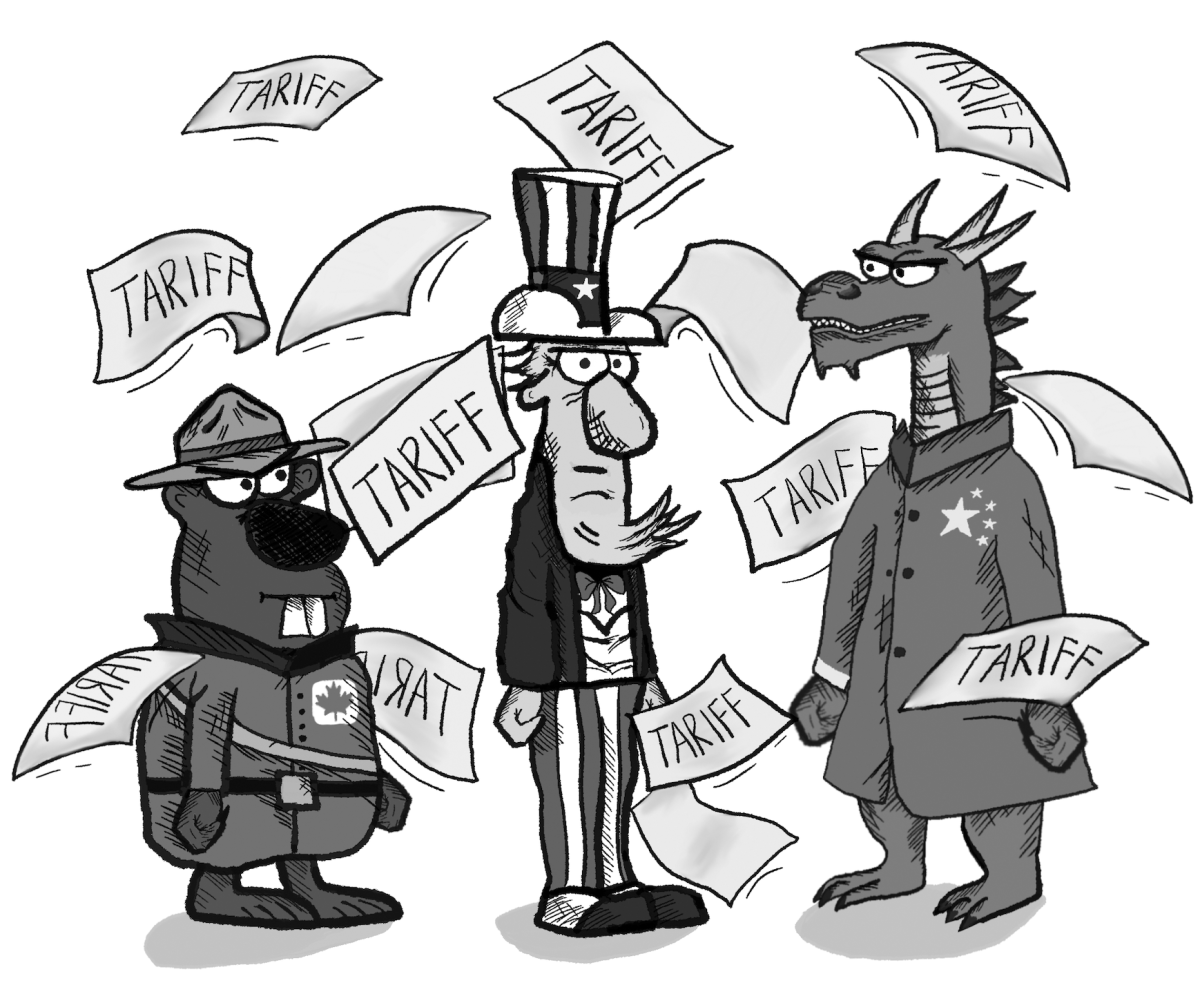

In a move his administration says will help the country prioritize domestic manufacturing and alleviate trade imbalances, President Donald Trump announced a plan on April 2 to set a 10% baseline tariff on all countries and raise tariff rates even more on others.

Part of this plan includes, for example, a 34% tariff on China and a 20% tariff on the European Union. The 10% baseline tariff will go into effect on April 5, and the individualized reciprocal tariffs will go into effect on April 9.

After the announcement, the Dow Jones Industrial Average futures lost 2.5% and S&P 500 futures dropped 3.6%. Technology stocks dropped as well, with shares of Tesla and Palantir down 8% and Apple shares falling by 7%.

Critics say these new tariffs violate international treaties – such as the United States-Mexico-Canada Agreement, a free trade agreement that was ratified under the first Trump administration – and rules created by the World Trade Organization, an international body that facilitates global trade.

AP Macroeconomics teacher Eric Bloom said tariffs discourage foreign exports to the United States, raising consumer prices.

“Tariffs are a tax on imported goods,” Bloom said. “It simply raises the price and fewer goods are sold because some importers are like, ‘You know what, I’m not going to bring in that stuff anymore. It’s too much trouble.’ Some foreign producers are like, ‘You know what, I’m just going to go to Mexico. I can sell as much as I want in Mexico, so I won’t worry about that.’”

Bloom also said the economic impacts of tariffs will make the United States vulnerable to recession.

“There’s a decrease in the total GDP and the total amount of output done in the United States is going to go down,” Bloom said. “Now, more of it might actually be from American manufacturers, but still, the total is down, and that’s the part that makes people worried about how it could trigger a recession.”

Because domestic manufacturers often have higher labor costs and stricter work standards compared to foreign competitors, Bloom said one benefit of Trump’s tariffs is they might protect domestic companies.

“Producers that used to not make profit because they were either new or inefficient in using old technology couldn’t compete anymore,” Bloom said. “But now (under tariffs), the price has risen, so there are more domestic producers that can meet that price and still make a profit.”

However, AP Macroeconomics teacher Grant Blackburn said the United State’s decision to break free trade agreements by imposing tariffs has aggravated its allies.

“It would be like if you and your best friend lived next door, and then your best friend threw something over the fence and hit you in the face with it,” Blackburn said. “You’re not going to be too happy about it, right?”

And Bloom said the impacts of tariffs aren’t just domestic; they are global because countries may retaliate with trade restrictions on the United States.

In response to Trump’s tariffs, Canada and Mexico immediately announced retaliatory tariffs on the United States, while China appears to remain open to negotiating.

Bloom said these retaliatory sanctions have made trade more inefficient.

“For 20 years, Canada, Mexico and the United States have been like a European Union,” Bloom said. “We were treating each other as one market, and that meant goods moved easily and without tariffs across the borders. Then we started innovating in manufacturing and (specializing in certain products).”

In the long term, junior and Vice President of the Economics Club Jerry Yan said increased domestic manufacturing from a tariff could increase the U.S. supply of goods and offset losses in trade.

“For example, Canada produces a lot of maple syrup, and if the US has a tariff on that, then maple syrup becomes more expensive,” Yan said. “Maybe the United States will start producing maple syrup more. Then, in the future, we might see the United States not relying on Canada

Furthermore, Blackburn said trade wars favor countries that can withstand economic strain.

“A tariff is something that can definitely hurt an economy and can also hurt our own,” Blackburn said. “The question becomes, how much can they stomach it? And we’ll have to wait to see.”

China’s retaliatory sanctions against the United States during Trump’s 2018 trade war led to the loss of nearly 300,000 jobs and an estimated 0.3% of real GDP.

Following a tariff, Blackburn said consumers typically experience higher costs for businesses.

“(Tariffs affect) the business side in the beginning, but ultimately, the consumers are the ones that will pay,” Blackburn said.

However, Yan said the exact impact of a tariff depends on the specific measure enacted.

“Much of the cost of tariffs goes to the consumer, but sometimes the firm also absorbs some of the cost,” Yan said. “If it’s a 5% to 10% tariff, then normally the firm just takes the cost. All in all, the net effect is more of a wash, because you don’t know what’s actually going to happen.”

And with reduced competition, Blackburn said domestic companies may also raise prices to maximize profit.

“If their competitors are forced to raise their prices to pay for the tariff, then why wouldn’t domestic producers just raise their price, maybe a little bit lower, but still competitive?” Blackburn said.

Ultimately, Bloom said the impact of tariffs on U.S. consumers will be regressive.

“The burden of tariffs are going to fall on consumers, which are people that spend most of the money they earn,” Bloom said. “If you’re making $50,000 a year, you’re spending 100% of your income. If everything goes up a little bit, then that’s going to impact you more.”

In the end, Blackburn said a tariff impacts every stakeholder differently.

“Is a tariff a good thing or a bad thing? Well, it depends. If you’re an American company that doesn’t have to pay the tariff, it’s a good thing because you get to raise your prices. If you’re someone who could benefit from getting a job from these companies that are coming into the US to avoid the tariff, that’s a good thing for you. If you’re the government, you’re getting tariff revenue. If you’re the American consumer, this is going to make things more expensive.”