The earth’s population has reached 8 billion, and as a result, advanced countries face a problem: the growing number of elderly.

According to Pew Research, despite the fact that nearly 20% of Americans live in multi-generational living situations, intergenerational relationships are still rare. When retirement homes are overly expensive and there is no time to care for the retired personally, people face the question: how will we take care of the elderly moving forward?

AP Environmental Science teacher Nicole Loomis said that other countries that have had a disproportionate number of senior citizens for a longer time than the U.S. provide insight into what the future could hold.

“In Japan, for example, one-third of their population is beyond retirement age,” Loomis said. “It means that there are fewer people to do the jobs and the economy starts to shrink.”

However, the shrinking economy is less of a pressing issue due to the large volume of immigrants who support the economy in America. Although future politicians may push for fewer immigrants, Loomis said that the economy is not the problem at hand, but helping the retired is.

Economics teacher Debbie Whitson said the U.S. established Social Security as the main incentive to help the retired, but it has become outdated due to the rising life expectancy.

“In the U.S., with modern health care and medicines, people live longer than when Social Security was established,” Whitson said. “Social Security was never intended to provide income to retirees for so many years as lifespans have increased.”

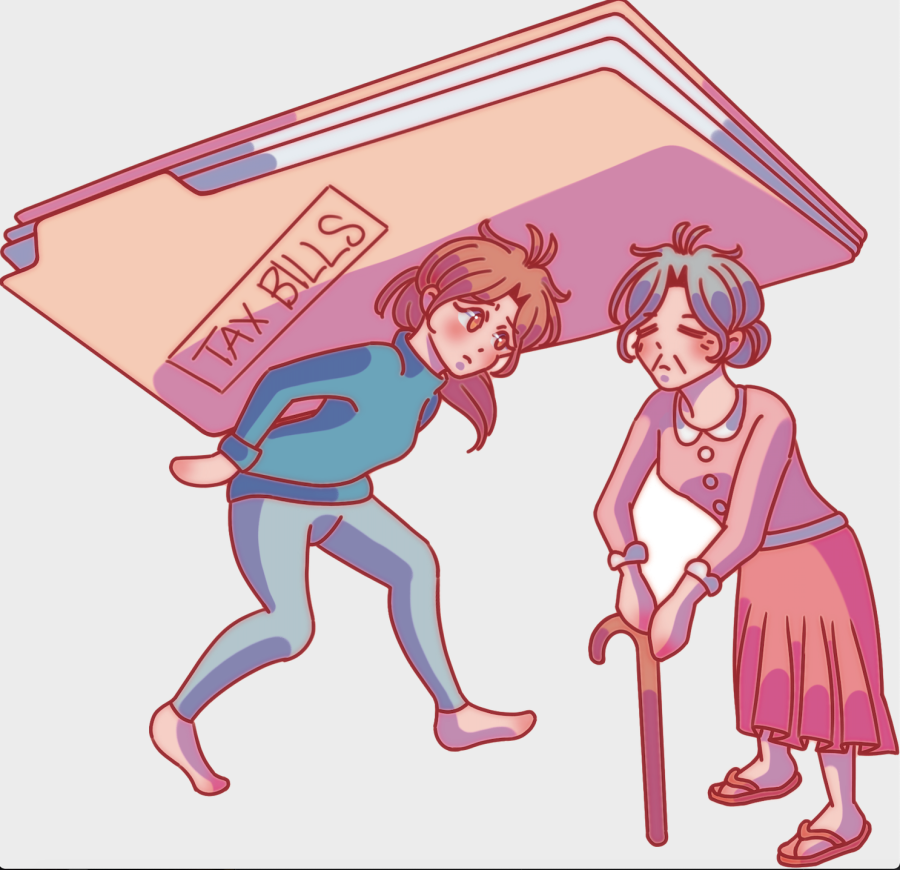

And Loomis said as people live longer, the money from social security taxes will become scarce.

“People pay social security, but as people live longer, that money is running out,” Loomis said. “So that’s the main issue that we face in a country that is aging.”

According to the Social Security Administration, 6.20% of income tax (and up to $147,000) goes towards Social Security programs. However, this money is not enough to support the elderly population as people live longer.

Furthermore, the new life span of America is 77.3 years, which means eligibility for social security should be shifted to late 60s or early 70s since retirement was assumed to span approximately 5 years when social security was established. However, Whitson said that this is a tough social shift that Americans will have a hard time facing.

“It has been a challenge to adjust the mindset of 65 being the age to retire,” Whitson said.

However, incentives have been made to increase the age of retirement and obtain social security benefits.”

Despite this setback, Whitson said that officials are working to combat the scarcity of money by increasing the retirement age.

“There are adjustments in the pipeline to make Social Security more sustainable,” Whitson said. “The full retirement age is being increased gradually and incentives are in place to have workers work longer.”

Additionally, Whitson said that there are motives in place that will ease the pushback of working longer.

“There are ways to provide incentives for them to work,” Whitson said. “Social security taxes paid by a business for older workers can be reduced making older workers cheaper to hire, and older workers can continue to earn a salary while also earning their social security check.”

Loomis also said the United States has established a number of assistance programs for the elderly to help them after retirement.

“We have a lot of nursing homes and assisted living facilities,” Loomis said. “But they’re expensive so the question is how much of the cost is going to be covered by people’s insurance, Medicare or Medicaid.”

Although an option is for the elderly to stay with their families, Loomis said that most adults in the US are already working, and are rarely at home to take care of their families.

“Right now, although there is a higher need for assisted living and care, we’re not seeing people step into the jobs,” Loomis said.

However, Loomis said that with further changes in the social security system, America could continue to support the elderly for some years.

“They’re increasing the age at which you can collect social security so they are trying to deal with the problem,” Loomis said. “So people will be working longer.”